FAQ

Frequently Asked Question to set up a Labuan Company

1. What is the tax rate for a Labuan company?

- Trading entities are taxed at 3% of audited net profits.

- Pure and Non Pure investment-holding entities (dividend income only) may enjoy 0% tax, provided they meet economic substance requirements.

- Non-qualifying activities may be subject to onshore Malaysian tax of 24%.

2. What are the minimum capital requirements?

There is no high minimum; incorporation can be done with nominal paid-up capital (e.g., USD 1). Higher capital may trigger higher government fees or banking due diligence.

3. What are the requirements for shareholders and directors?

A Labuan company requires at least 1 shareholder and 1 director, who may be individuals or corporates of any nationality. 100% foreign ownership is permitted.

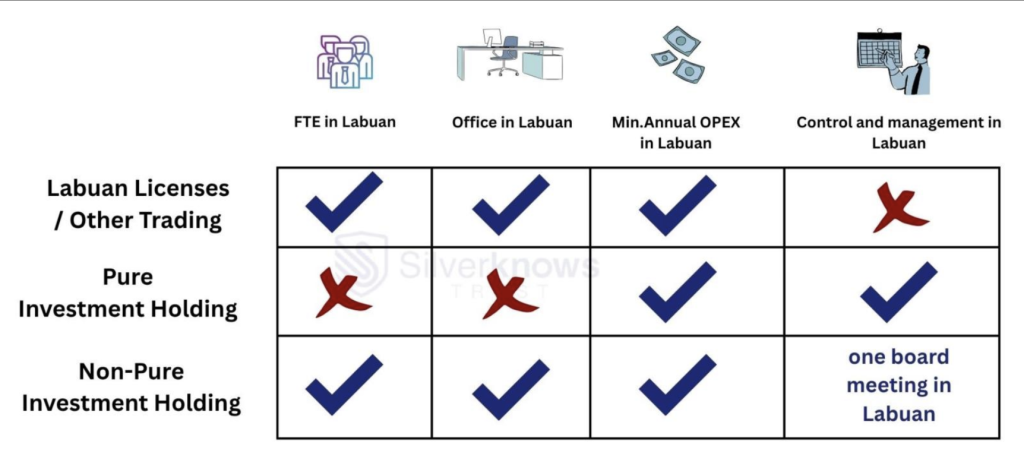

4. What are the economic substance requirements?

To enjoy tax benefits, companies must maintain substance in Labuan:

5. Can foreigners own or operate a Labuan company?

Yes. Foreign individuals and corporates can own and operate a Labuan entity without nationality restrictions.

6. How long does it take to incorporate?

Generally 7–14 working days after KYC approval and receipt of full documentation.

7. What are the costs of setup and maintenance?

Setup and maintenance costs may vary with your company’s needs. Contact us for a customized breakdown

8. Are audits and filings required?

Yes. All companies must file annual return and tax return.

9. Do I need to be physically present in Labuan?

Incorporating a Labuan company is a straightforward process that can be completed entirely remotely, making it convenient for clients who are based overseas. However, when it comes to bank account opening, requirements vary depending on the bank. While some banks allow remote applications, many still require the company’s directors or authorized signatories to attend in person for verification and compliance purposes. This ensures that all regulatory and due diligence standards are properly met.

10. What are the benefits of a Labuan company?

- Attractive tax framework (3% or 0%).

- Full foreign ownership permitted.

- Ease of setup and operation.

- Confidentiality of ownership and accounts.

- Access to Malaysia’s financial system and double tax agreement or treaty network.

11. How is the banking system for Labuan entities?

- You can open multi-currency accounts to hold and manage funds in USD, EUR, SGD, and more.

- It supports smooth international transactions, trade finance, and cross-border payments through established global banks.

- Labuan is also embracing fintech and digital services, with licensed digital banks and platforms offering innovative financial solutions.

- And for high-net-worth clients, private banking and wealth management services are available, with attractive tax benefits and Shariah-compliant options

Contact:

General Line: +603-9543 1882 Business Enquiry: +6012-2600 633

Email:

hello@silverknows.com

Office Hours:

Mon-Fri: 8.30am - 5.30pm